Selling custom furniture on Shopify, without the checkout drop-off

Downpay helps custom furniture sellers on Shopify reduce abandoned carts and increase conversion by offering deposits, improving customer trust and cash flow.

The ultimate guide to boosting conversion and trust with Downpay

Selling custom or made-to-order furniture online isn’t easy. Long lead times, high price points, and complex fulfillment make it harder for customers to feel confident hitting “Buy Now.” If you’re using Shopify, there’s another challenge: by default, the platform only supports full payment up front.

That creates friction at the worst possible moment: checkout. Customers hesitate. They bounce. And shoppers for home furnishings abandon carts one of the highest rates of any industry: 80%, according to a 2024 report by Oberlo.

As former Shopify employees, we saw this problem again and again. So we built Downpay—a white-label, Shopify-native app that lets you take deposits and partial payments right in your existing checkout.

With Downpay, customers can lock in their orders with an initial payment. Then you can collect the balance automatically before delivery—on your schedule—using the card on file.

Downpay is made for brands selling high-value products on longer timelines. Companies that need a more flexible path to conversion, without compromising on trust or cash flow.

Check out how Premium Sofas uses Downpay:

Read on to learn about:

- The challenges made-to-order furniture merchants face selling online

- Why Shopify's native checkout functionality is a barrier

- The sales benefits of offering a deposit plan

- How deposit plans help your company grow sustainably

- How Downpay enables deposits on Shopify

- Setting up Downpay

- Best practices used by custom furniture merchants

- Real furniture merchants using Downpay

- Common questions and answers

Why selling made-to-order furniture online is unique

Made-to-order furniture sellers face five specific challenges that Shopify doesn't solve out of the box:

1. Long lead times

Production and delivery for custom furniture can take weeks or months. This delay makes customers nervous, and can result in support tickets, cancellations, or chargebacks.

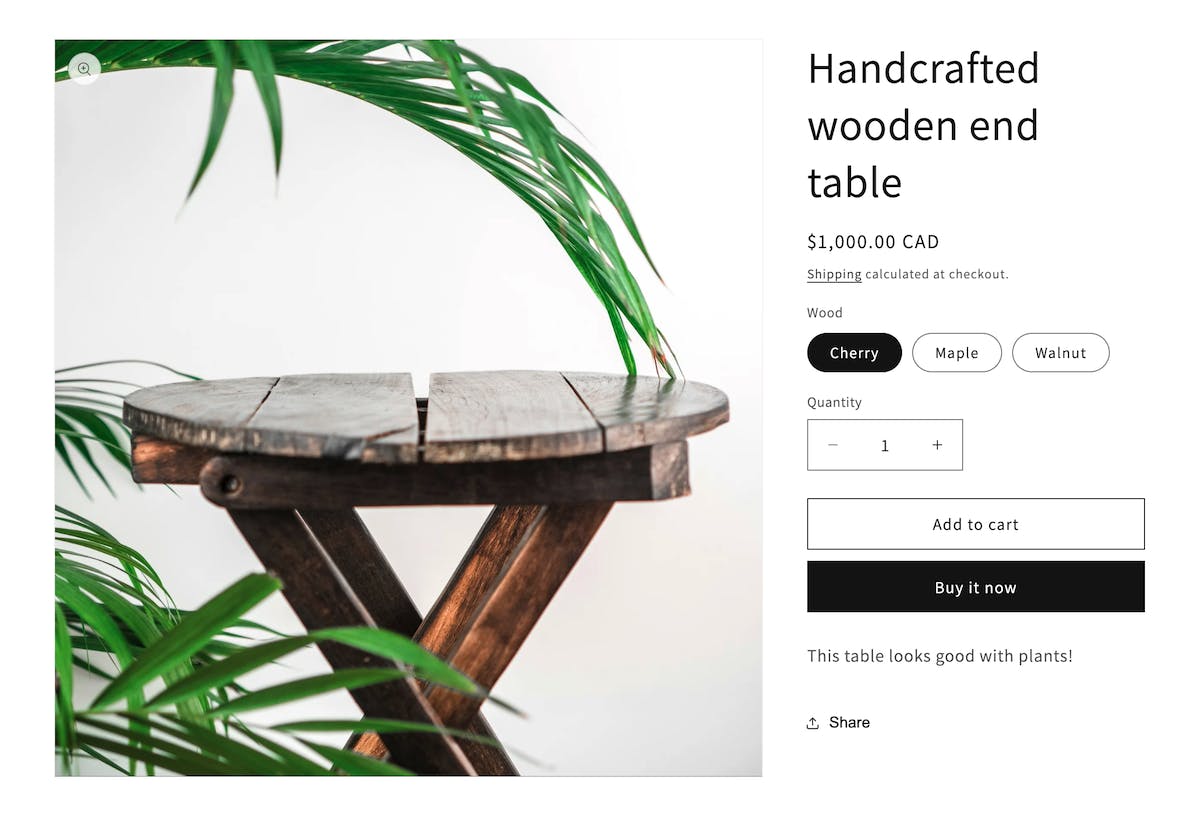

2. High average order value (AOV)

Furniture purchases are often over $1,000. That sticker price triggers hesitation, especially when the customer has to pay in full up front.

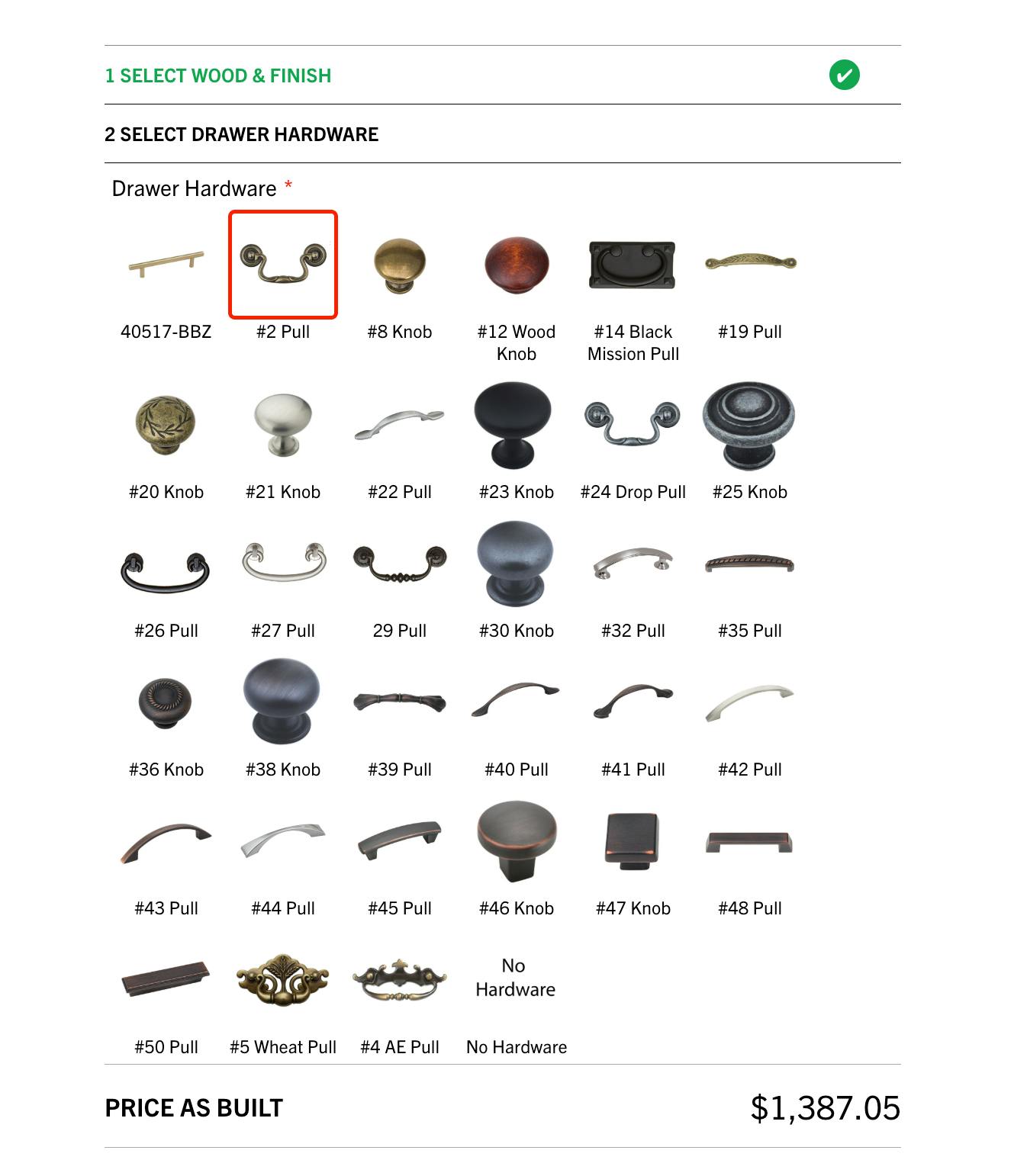

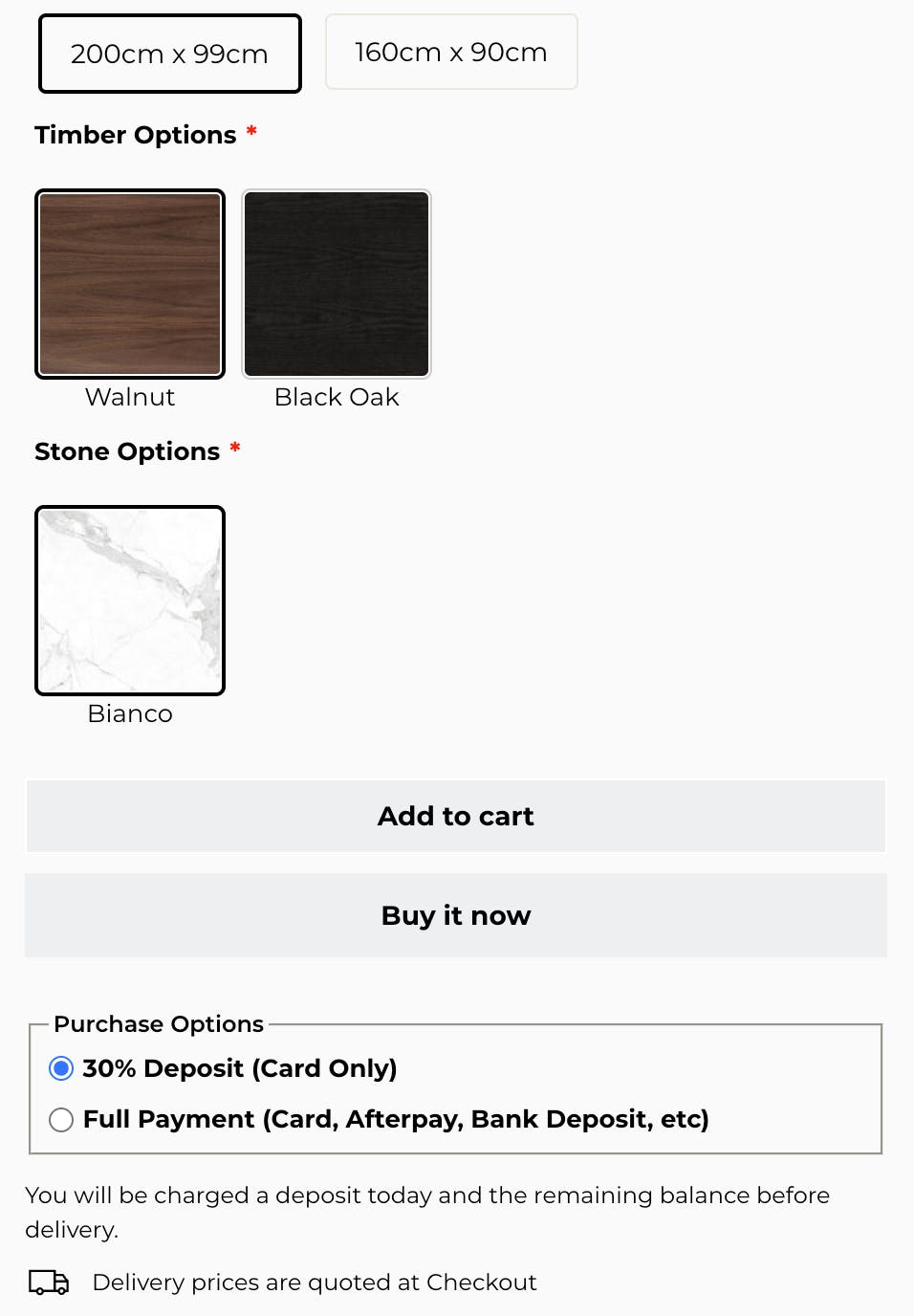

3. Complex product options

Custom builds may involve dozens of variations: wood types, stains, sizes, hardware, cushions. Shopify’s native variant and option limits mean merchants often need to use product options apps to offer the full set to customers.

Made-to-order merchants like Snyder's Furniture offer build options on their online stores via apps like DPO

4. Trust and credibility gaps

Customers need reassurance before paying for something they haven’t seen—especially from an unfamiliar merchant. Flexibility in payment terms (like deposits) builds confidence.

5. Operational complexity

Inventory management isn’t as simple as "in stock" and "not in stock." Furniture that is made to order, fully or semi-custom, or backordered complicates inventory syncing, fulfillment, and messaging.

Limitations of Shopify’s native checkout

Shopify’s checkout was designed for fast-moving consumer goods, not $3,000 made-to-order tables. If you’re selling custom furniture on Shopify, here’s what you’re up against:

No deposits or partial payments

By default, Shopify collects 100% of the order total at checkout. There’s no way to accept an initial deposit through your online store and collect the remainder later.

Out of the box, customers on Shopify stores don't have any options besides paying up front.

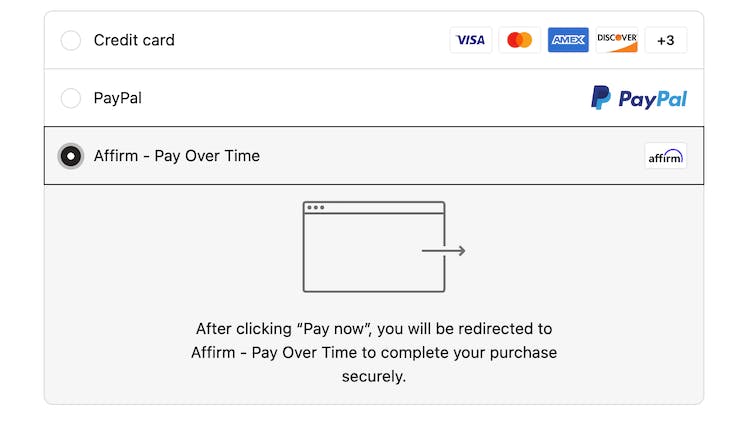

Buy Now, Pay Later (BNPL) doesn’t fit

Consumer loan apps like Klarna or Afterpay charge high merchant transaction fees on big-ticket items. Fees as high as 10% mean you could be paying them $300 on that $3000 table.

They also redirect customers away from your site. You lose control of terms and branding, and your customers can get confused and frustrated.

Customers using BNPL leave your checkout for the provider's flow in order to secure a loan.

Manual invoicing doesn’t scale

Some merchants send a draft order or invoice manually, but this still means collecting only one lump payment—unless you're on a Plus plan. At scale, invoicing is error-prone and time-consuming. Customers also don't like being chased for payment—and you don't like unpredictable cash flow.

In short: Shopify’s native setup doesn’t reflect the way custom furniture is actually sold.

Why deposits convert better

Merchants using Downpay to collect deposits on custom furniture have reported major increases in conversion and decreases in abandoned carts.

The flexibility of deposit-based payment terms lowers psychological friction, improving sales metrics.

Reduces perceived risk

Instead of paying $2,000 now for a sofa they won’t receive for 2 months, customers can secure an order with a $600 deposit. That smaller investment makes a big difference. It's like a more modern, buyer-friendly form of layaway.

Builds trust

Customers feel respected and can tell that you relate to them. Asking to hold onto thousands of dollars of their money for months feels impersonal and like their needs don't matter.

Success Stories

Check out Downpay's case studies to learn about how furniture brands saw big gains in conversion:

+47%

Conversion

+30%

Conversion

How deposits help you grow sustainably

As well as directly increasing conversion and revenue, deposit plans make running your business more predictable:

Eases cash flow planning

Taking deposits gives you predictable revenue during long lead times. It also reduces cancellations, since customers feel more committed after making a payment.

Enables more accurate order management

With partial payments and automated flows, you can keep better track of committed revenue vs. potential revenue, forecast production demand, and schedule fulfillment windows more precisely.

Why Downpay for deposits

Downpay is purpose-built for custom product brands using Shopify. Here’s what sets it apart:

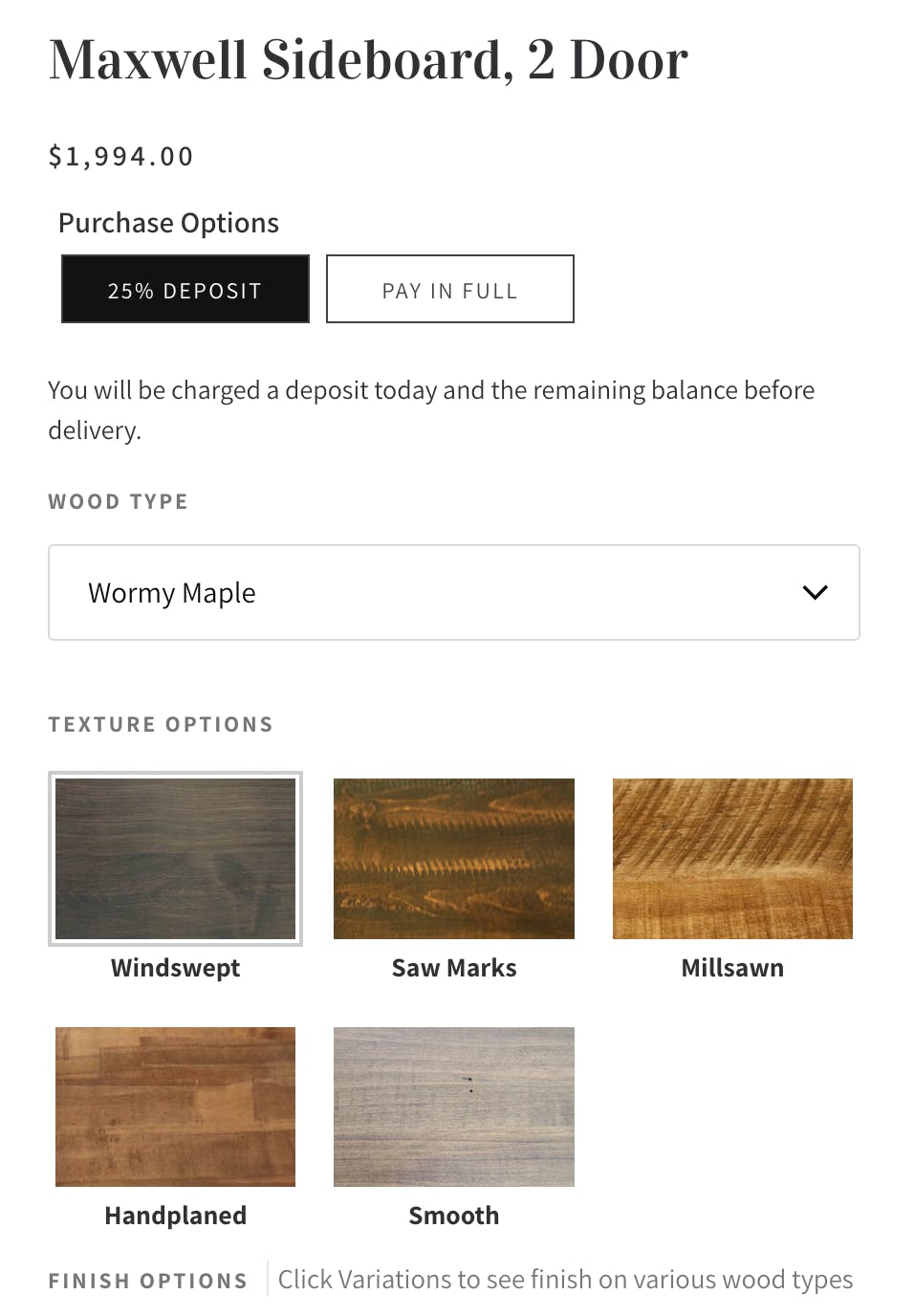

Your brand, your way

A full white-label solution, Downpay lives inside your Shopify store and matches your existing theme. You can further customize it however you like.

Gainsville uses radio style buttons to fit their aesthetic...

...and Rustic to Refined uses toggle buttons.

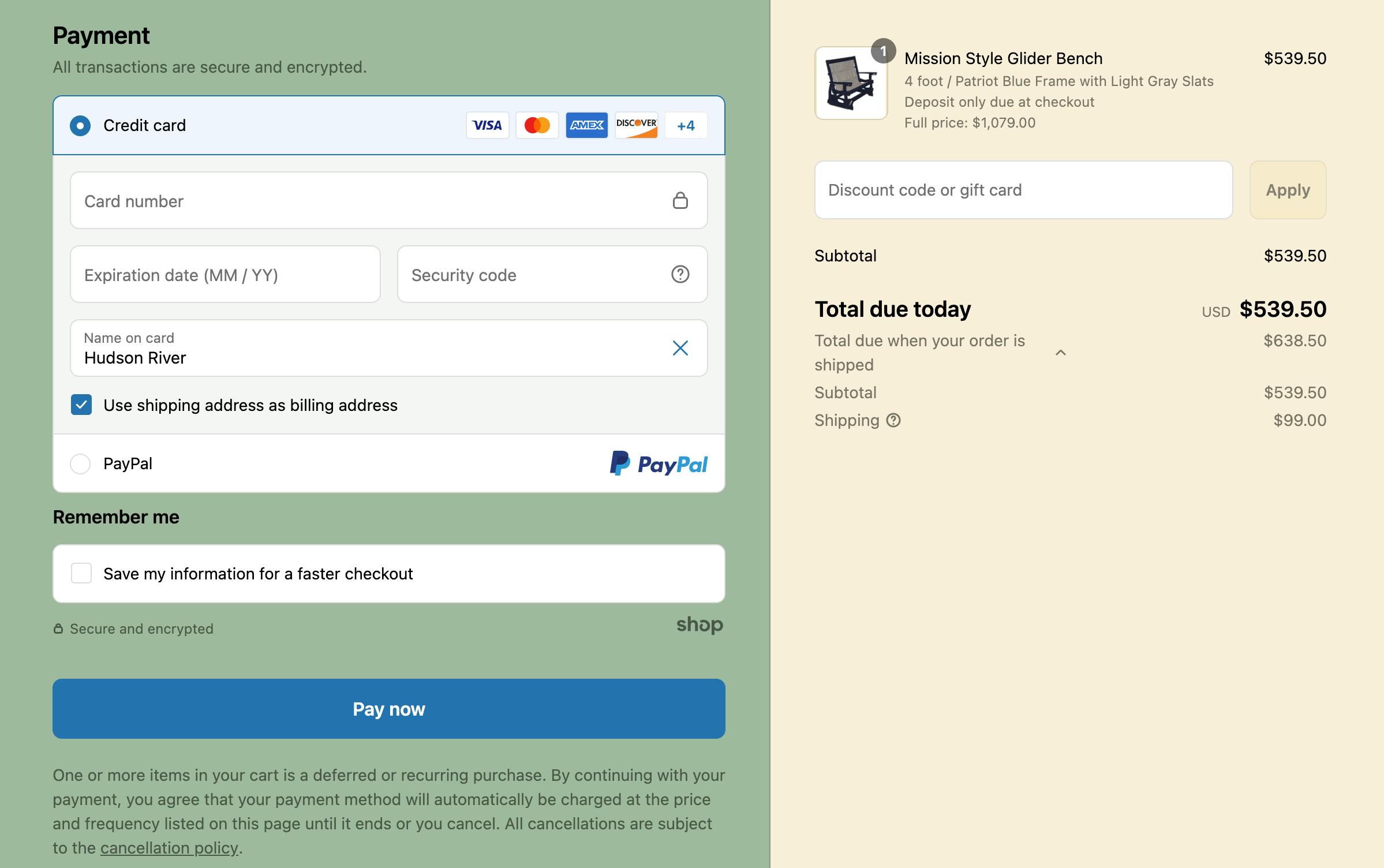

Native Shopify checkout integration

Customers pay with credit cards through your branded Shopify checkout—the world's highest converting—with broken down subtotals and no confusing redirection. Downpay supports the most common gateways on Shopify.

Modern Bungalow’s checkout. (Note that taxes and shipping are deferred until the full balance is collected.)

Card on file

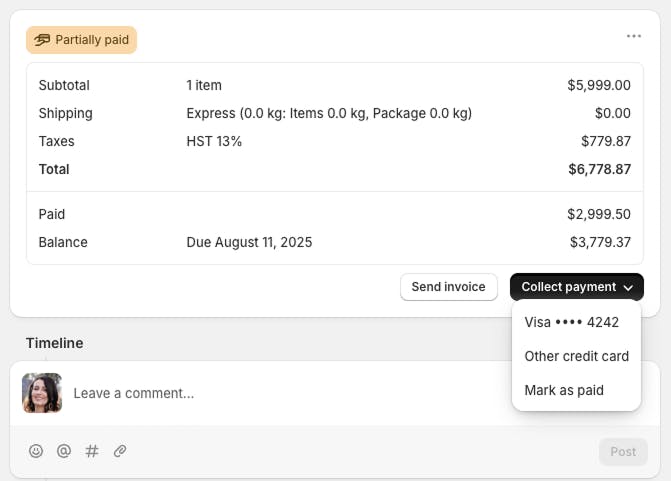

Downpay uses Shopify's secure card vaulting to collect the balance from the customer's card on file when you're ready to fulfill the order—manually or automatically.

Set your own terms

Define the deposit percentage and policy, timeline for balance collection, and even let customers choose to pay in full.

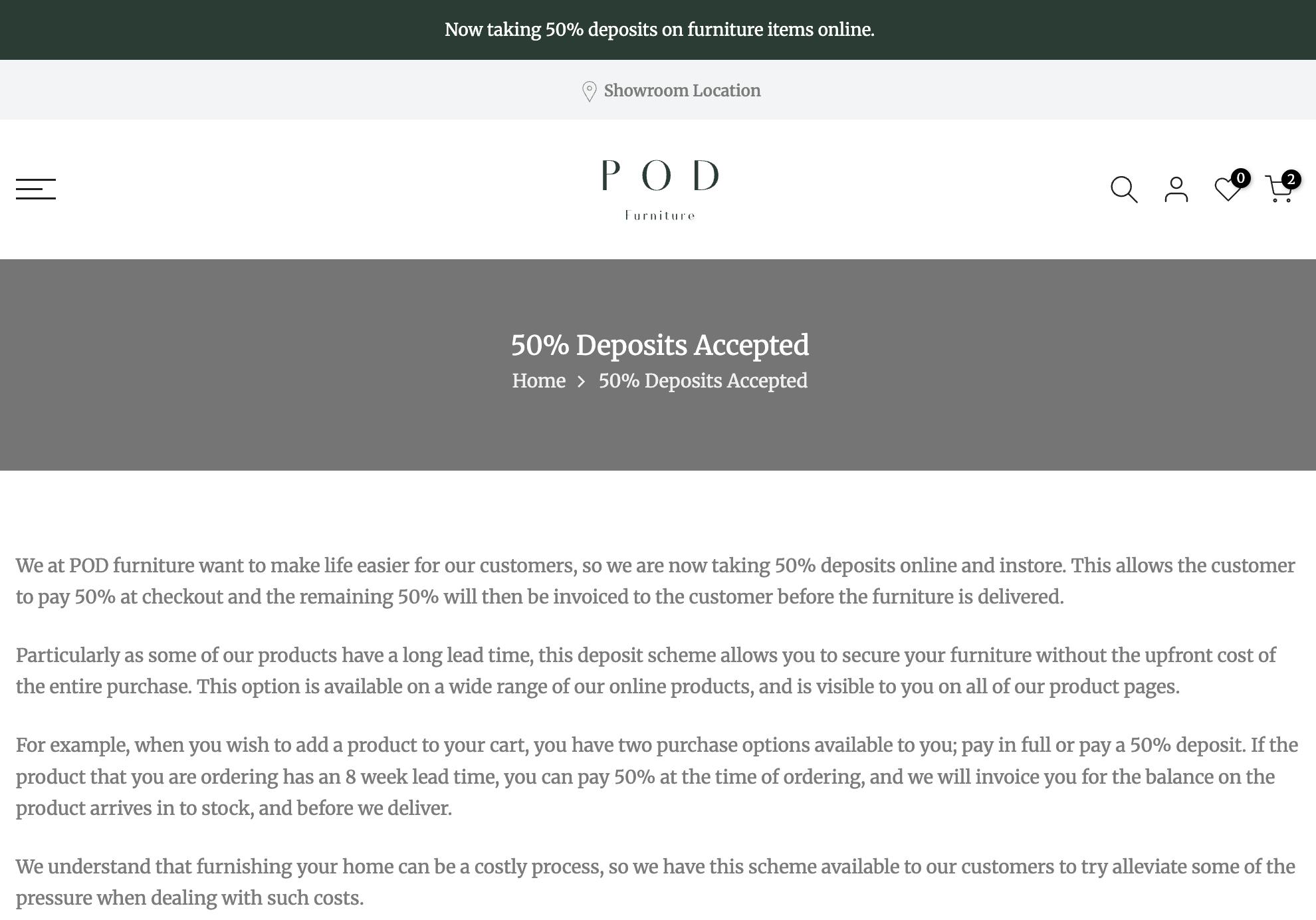

POD Furniture clearly explains how and why they take deposits on Shopify.

Self-service for customers

Customers can update their cards, view their remaining balance, or pay early through Downpay's Shopify customer portal integration.

Reduce toil and errors

Downpay Shopify Flow triggers let you automate reminders, invoices, charge attempts, and internal workflows at scale.

For more complex scenarios, Downpay's API supports all of the features of the app.

How to set it up (step-by-step)

Setting up deposits with Downpay is fast and flexible. Here’s how furniture brands do it:

1. Install Downpay

Add it through the Shopify App Store and confirm you use a supported payment gateway.

2. Create a purchase option

In the Downpay app, define:

- Deposit percentage or amount (e.g., 30% now, or $500 down)

- Products or variants it applies to

- Whether to allow payment in full

- Balance due date (fixed or relative to checkout)

You can have more than one purchase option, if you want to offer different terms in different scenarios or on different products.

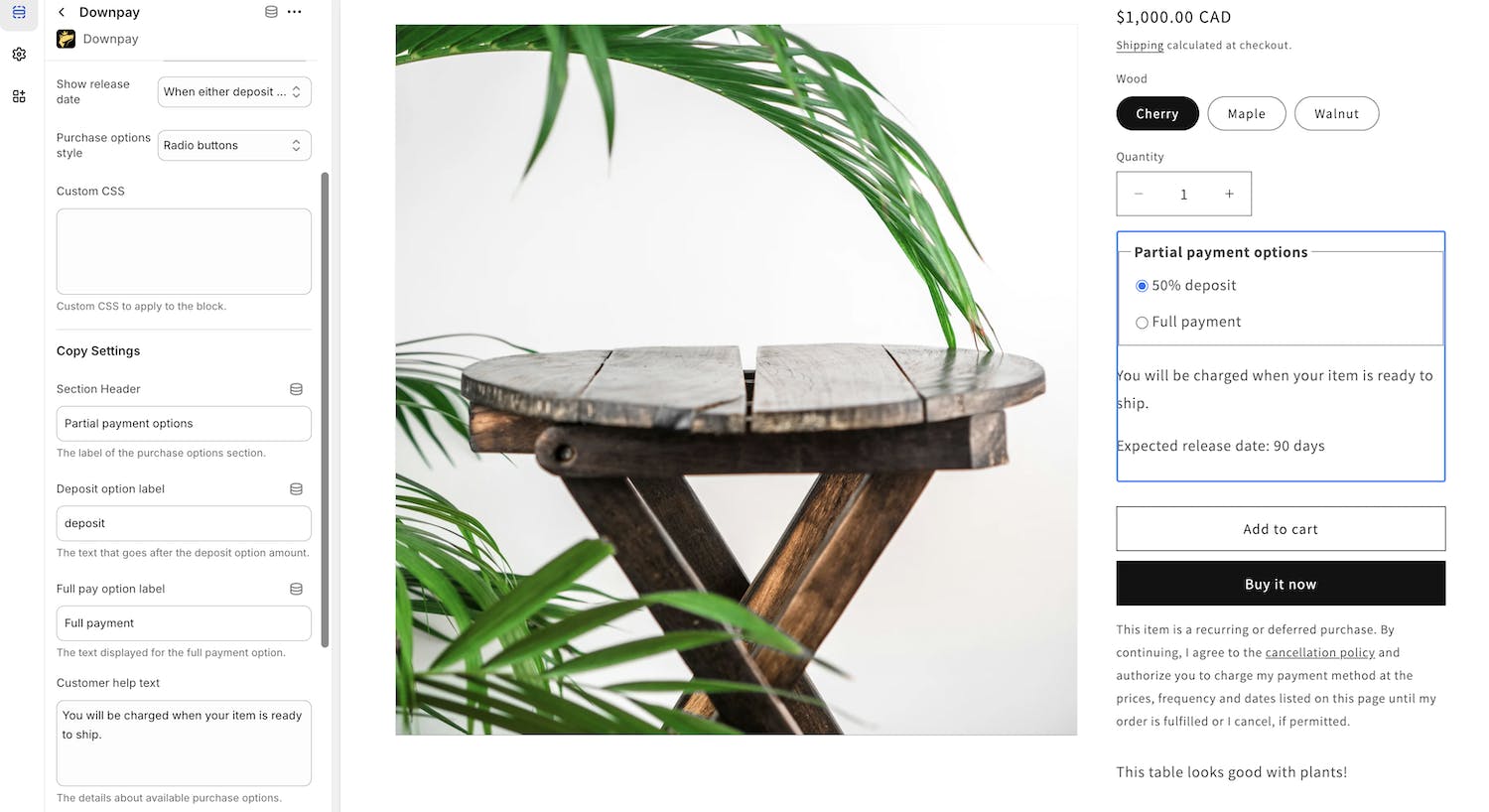

3. Add the theme block

Drag-and-drop the Downpay block onto your product page (or cart). Customize styling and copy as needed.

Use the design and copy settings in the theme editor, add your own CSS, or even edit the theme files directly.

4. Configure customer messaging

Explain what’s due now vs. later, link to your terms, and preview how it looks on desktop and mobile.

5. Test making an order and collecting payment

Use Shopify’s test gateway to experience placing an order on your online store and collecting the balance.

You can collect balances manually or automate it with Shopify Flow or the Downpay API.

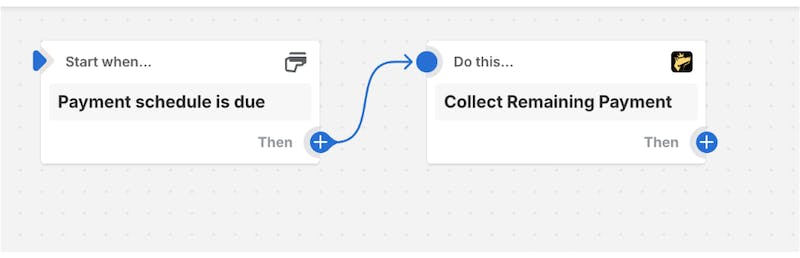

6. Automate balance collection and notifications (Optional)

You can use Shopify Flow or API calls to perform workflows at scale:

- Charge stored cards

- Send reminders

- Trigger fulfillment

Automating payment collection with Shopify Flow really is as simple as that!

7. Set up other app integrations (Optional)

Downpay integrates directly with third-party apps that make buying even more frictionless and build confidence in your brand.

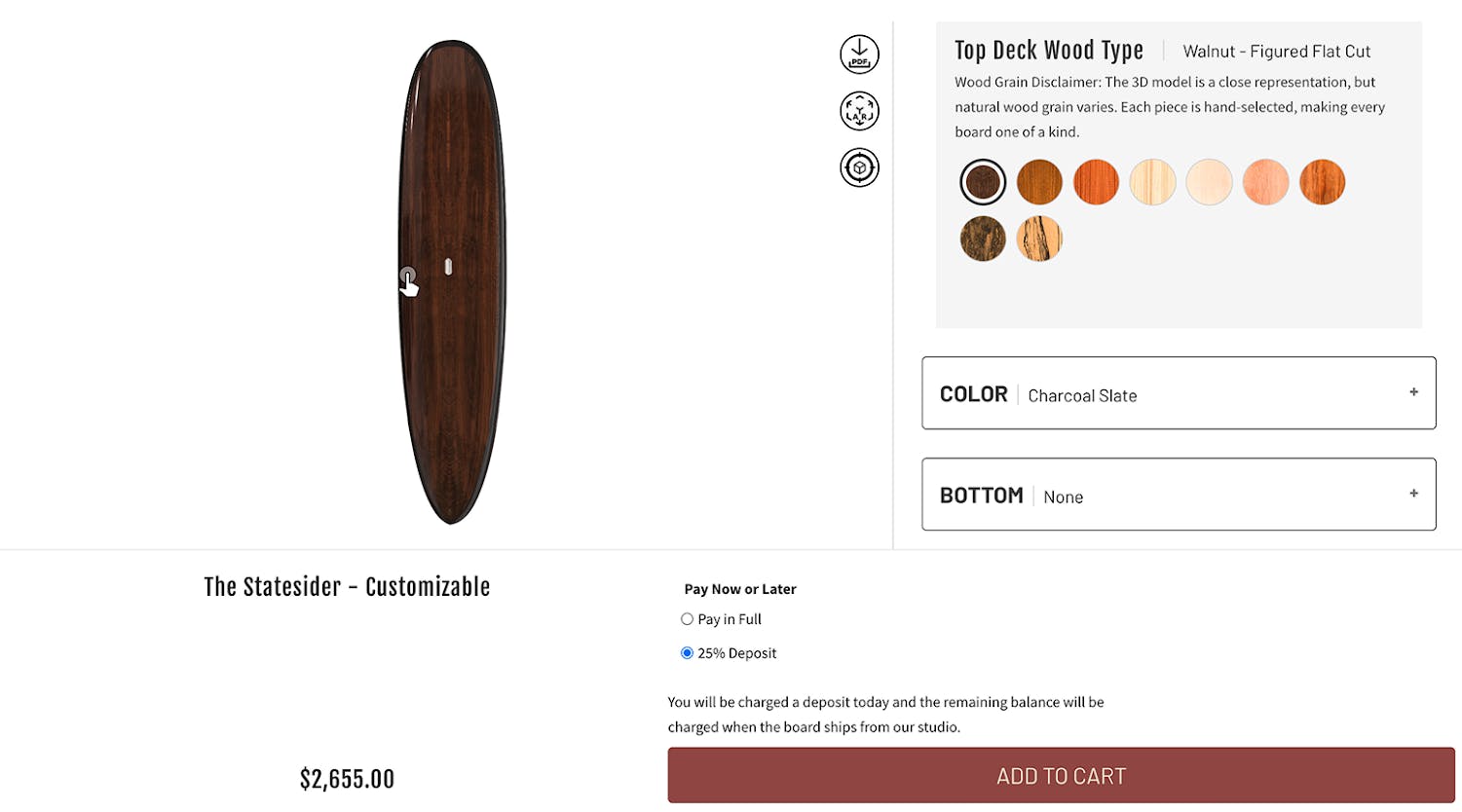

Jarvis Boards uses the Angle3D integration to show a 360-degree view of their custom wooden paddleboards.

Best practices for selling furniture with deposits

Downpay unlocks a powerful checkout experience that lets you configure it how you want. Here are some best practices we've seen merchants follow for presentation and messaging:

On the product page

- Display deposit terms clearly, such as “30% due today, balance before delivery”

- Use Downpay’s theme block near the price or above the Add to Cart button (unless you put it in the cart instead)

- Offer full payment as an option for customers who prefer it

In the cart

- Customize help text for the breakdown between deposit and balance

- Link to your deposit policy and other relevant terms

- Remind customers about lead times, either through the policy or otherwise

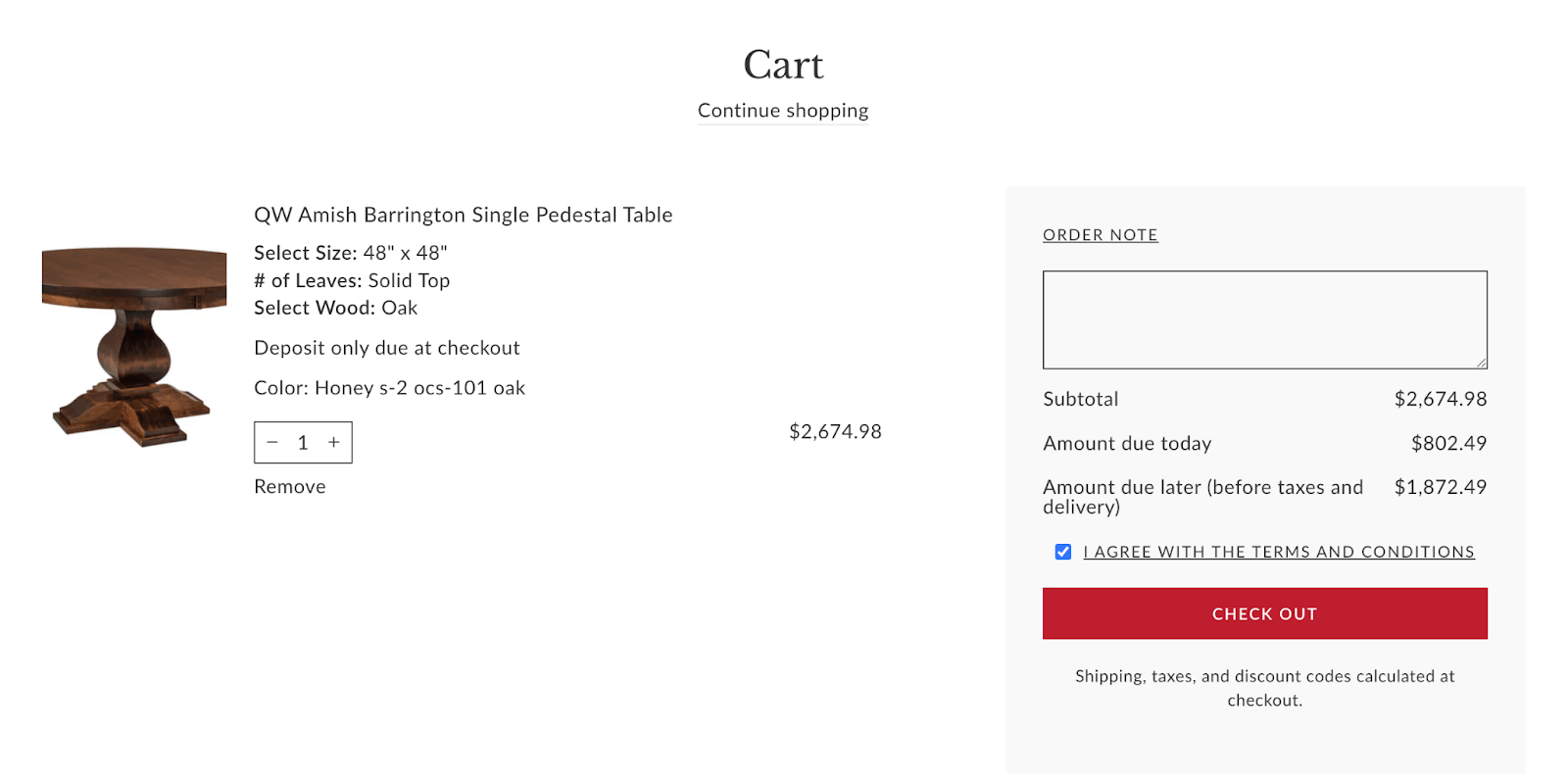

QW Furniture asks customers to agree with the linked terms and conditions, and clearly explains the cost breakdown.

Post-checkout

- Set up automated emails that fit your business model, such as:

- Order confirmation (with deposit summary)

- Reminder emails before charging the balance

- Authorization or payment success/failure notifications

Policy transparency

- Publish a clear refund and cancellation policy

- Note how taxes and shipping are handled (deferred until final payment)

Test and optimize

- A/B test deposit percentages (e.g. 25%, 30%, 50%) to find the best balance

- Track conversion rates and abandonment by payment method

- Adjust copy or placement based on performance

Real furniture merchants using Downpay

Custom furniture sellers across North America, Europe, and Oceania use Downpay:

Modern Bungalow sells USA-crafted wood furniture and handmade decor.

Family-run US store QW Furniture carries Amish-made indoor and outdoor home furniture.

Australia's Gainsville Furniture develops and produces bespoke luxury furniture from Australian and international designers.

Irish POD Furniture sells high-end European furniture, including handcrafted pieces from dining tables to sofas to artwork.

Cymru Camper Furniture, hailing from Wales, builds bespoke furniture for high-end camper conversions.

For 40 years, Snyder's Furniture has sold US Amish-built oak, cherry and maple furniture, including custom pieces and decor.

Online Amish Furniture offers handcrafted American-made oak furniture from mission style to formal styles.

These brands each set their Shopify stores up their own way—including different base themes—but they all benefit from a smoother, more flexible checkout experience.

Frequently asked questions

Can I take deposits on Shopify?

Yes, but not natively. Use an app like Downpay to enable deposits directly in your existing checkout.

Why should I offer deposits for custom or made-to-order furniture?

Deposits reduce friction, build trust, and support better cash flow.

How does Downpay work with Shopify?

It integrates natively, collects partial payments, and lets you charge the balance before fulfillment, manually or automatically.

Do I need to change my payment gateway to use Downpay?

Downpay works with the most common payment gateways on Shopify: Shopify Payments, Stripe, Paypal Express, as well as Ayden for merchants on Plus plans.

What kinds of businesses use Downpay?

Custom furniture, home goods, and other high-AOV brands with long lead times.

Can I customize the deposit messaging and rules?

Yes. Downpay is built for flexibility.

How do I use Downpay for fully custom products?

You can create hidden product pages with the price and options the customer has selected.

Is Downpay secure and compliant?

Yes. It uses Shopify’s secure card vaulting, which complies with PCI standards. Downpay doesn't see your card details.

How do I get started?

Install from the Shopify App Store, set deposit rules, add the Downpay embedded block to your theme, and test it out. Initial setup takes minutes.