See before you pay: How Welham & Co grew sales for custom portraits by 25%

Using Downpay, Welham & Co defers collecting payment until customers approve their pieces. Building confidence with this $0-upfront approach led to a drop in abandoned carts and checkouts and a big jump in conversion.

With Downpay, we were able to completely squash customer doubt. Our sales have gone up significantly.

— Luke Benjamin, Founder, Welham & Co

Erasing pre-purchase hesitation with Downpay

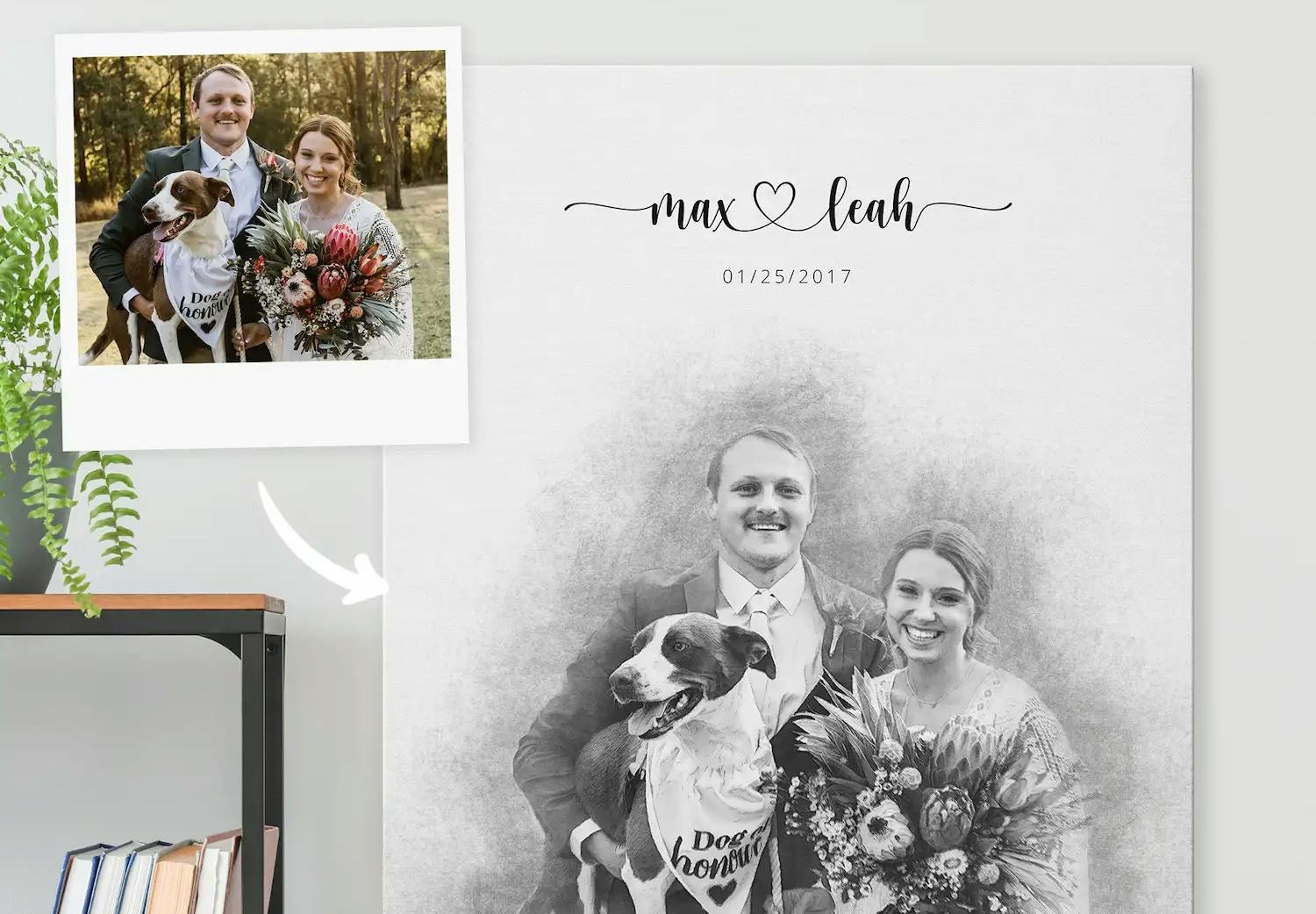

Custom portraits are deeply personal, and many of Welham & Co's customers hesitated to pay upfront without seeing the product.

Approving the design before paying would reassure customers. But individually invoicing customers, the only option native to Shopify, wasn't feasible at a global scale.

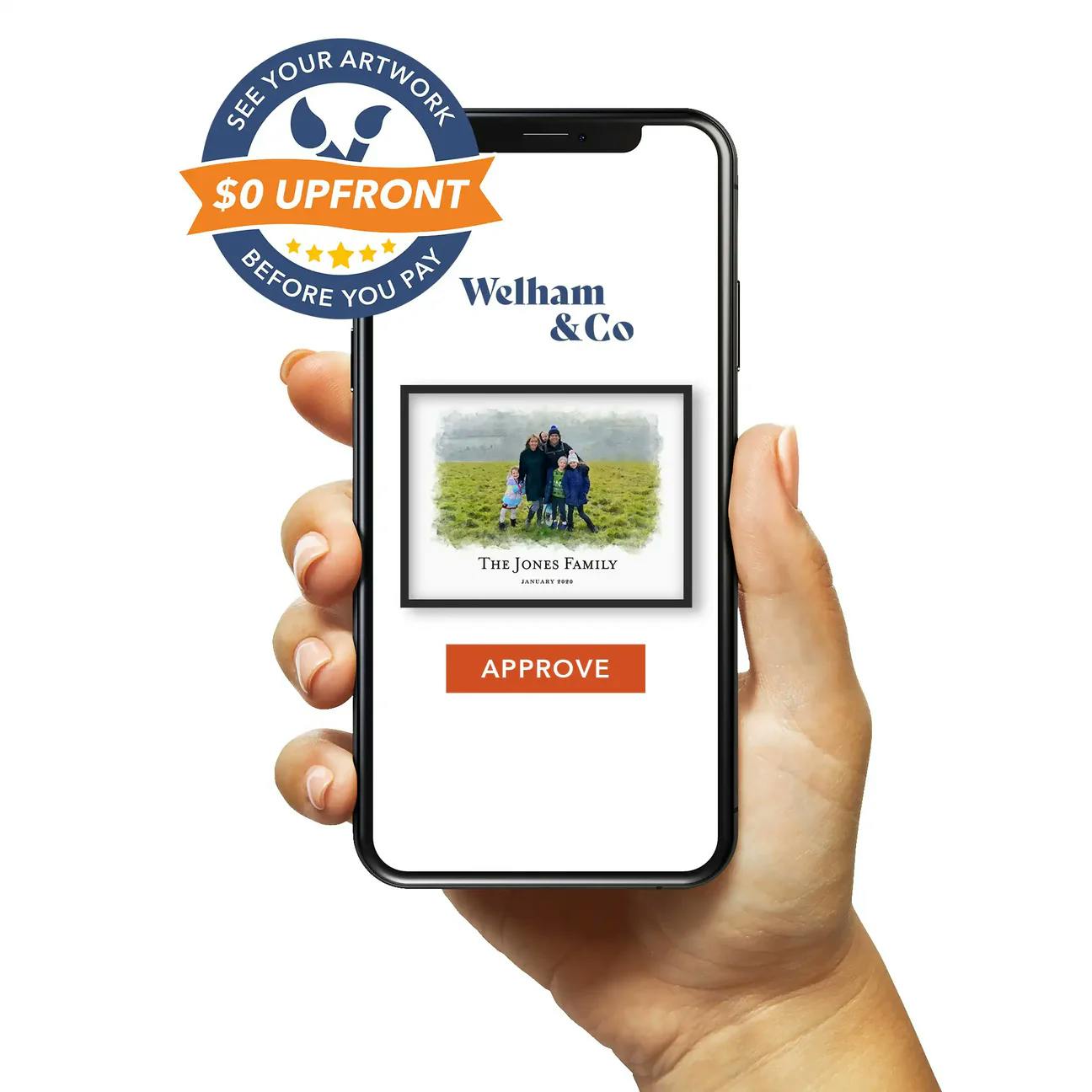

With the Shopify split payments app Downpay, however, Welham & Co's customers can now select a $0-upfront option.

They still go through the store's branded Shopify checkout, but they aren't charged until they're happy with the design.

With deferred payment a key part of their brand, Welham & Co has removed a major reason for abandoned orders, and seen a huge lift to sales and conversion.

Welham & Co's story

Based in Brampton, Canada, Welham & Co transforms customers’ most meaningful memories into artwork, from weddings, to favorite places, to memorials.

Sustainability is critical to founder Luke Benjamin. As well as using renewable wood products and sponsoring tree planting, the company makes portraits and frames as close to each global customer as possible, at facilities worldwide.

The emotional nature of the work was why Luke started the company, but it was also a major source of difficulty.

[The hesitation] was due to our offering being a custom product, and customers not being sure exactly how the final product would look when they were paying upfront.

— Luke Benjamin, Founder, Welham & Co

The problem: Paying upfront for unseen custom products

Paying the full amount at checkout for something so personally meaningful felt risky.

Luke and his company wanted to:

- Build trust and transparency into the buying process

- Reduce cart abandonment and checkout drop-off caused by uncertainty

- Keep cash flow steady without adding manual work

In the print industry in general, customers pay once they approve proofs of the design.

Shopify doesn't support deferred payment natively, however. The online store is focused on merchants who collect payment upfront for in-stock items, not custom items with a lead time.

And at Welham & Co's global scale, they couldn't manage the toil and cashflow issues associated with individual invoices.

Some merchants use Buy Now, Pay Later apps to offer more flexible payments on Shopify and reduce hesitation, but they don't solve this particular problem. The customer is still paying upfront for a custom product they haven't seen—they are just taking out a consumer loan in order to do it.

Welham & Co. needed to look further into other Shopify partial payment apps.

The solution: See it first, then say yes

Downpay, built by Shopify alumni, was the technical solution the company needed, and the basis for a new brand direction.

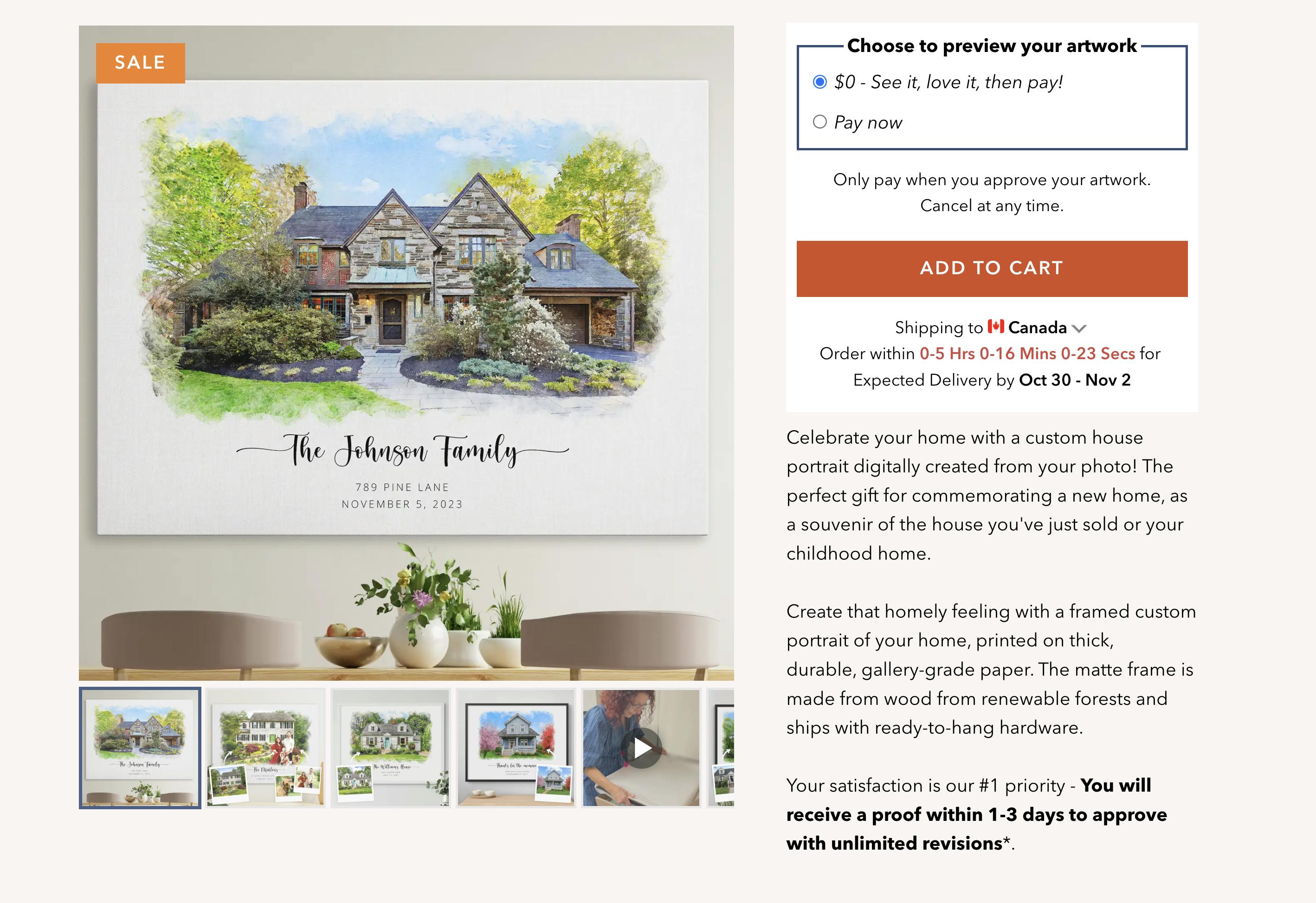

Using the Shopify-native app, Welham & Co could introduce a $0-upfront option.

Customers follow these steps:

- Upload their photos and instructions

- Leave their payment details at checkout, without any charge

- Receive a digital proof within a few days

- Approve the proof once they’re satisfied

- Have their card charged automatically

The company's promise You deserve to fall in love with your portrait before you pay now sits at the heart of their brand experience.

This fully deferred payment model, which also has uses in other industries, gives customers peace of mind.

And with Downpay's automated features, the business can maintain predictable cashflow. There's no toil from managing invoices or chasing people down for payment.

Our customers appreciate the flexibility to pay only once they approve their custom order.

— Luke Benjamin, Founder, Welham & Co

Why Downpay was the right fit

- Customizable split payment options with 0-100% upfront

- A whitelabel, Shopify-native solution

- Automated collection of the balance from the card on file

- No manual invoicing or off-platform coordination

Welham & Co. could easily integrate Downpay into their Shopify storefront:

You can explore how Downpay works yourself in the interactive demo.

Results: A boost to sales and conversion

Without any uncertainty over paying in advance, Welham & Co’s buying experience feels effortless.

Customers enjoy full creative control, leading to greater satisfaction with their products. And the brand is seeing significant growth through higher order volumes.

How high? Since implementing Downpay, they've seen:

Conversion growth

Sales growth

Doubt over pre-payment

The takeaway

For Welham & Co, fully deferred payments on Shopify built trust, decreased friction, and reduced checkout drop-off and abandoned carts. They now offer a flexible payment experience that reassures customers that they'll get exactly the artwork they pay for.

Read more case studies and learn how Downpay can enable higher sales for Shopify merchants.