Frame made 20% of BFCM sales while sold out by taking deposits on Shopify

When sudden demand emptied inventory, Downpay let high-end Pilates equipment brand Frame keep revenue flowing and reduced customer frustration.

Using Downpay to keep selling when demand surges, with no cancellations

When early buzz for Frame's high-end connected Pilates reformer turned into viral demand, the company had to find a long-term solution for securing orders during sold out periods—like the one that was fast approaching.

The team at Frame knew that unexpected shortages were going to happen despite their best efforts to manage inventory.

They had tried charging up front, as well as collecting customer emails for in-stock notifications. But neither appealed to customers, and they didn't bring in much revenue. Invoicing was not feasible at their scale, and Buy Now, Pay Later didn't fit with their market.

Taking deposits through their Shopify online store seemed like the best solution, but the available options for doing that were not looking promising until they found Downpay.

With the Downpay app, Frame could collect partial payment inside the Shopify checkout and then automatically charge the card on file for the balance. And their collection success rate? 100%.

This meant that when demand exceeded forecasts during Black Friday, Cyber Monday, they could keep selling, ensuring cash flow and saving customers from disappointment.

Read on to learn about:

- How Frame started

- The challenge they faced with inventory shortages from sudden demand

- The potential solutions Frame considered

- Why they chose Downpay for deposits on Shopify

- How Downpay let Frame monetize no-revenue periods

The story behind Frame: Bringing the studio to the user

You can jump on a Reformer and take control of your journey.

— Tom Youzwyshyn, Head of Growth, Frame

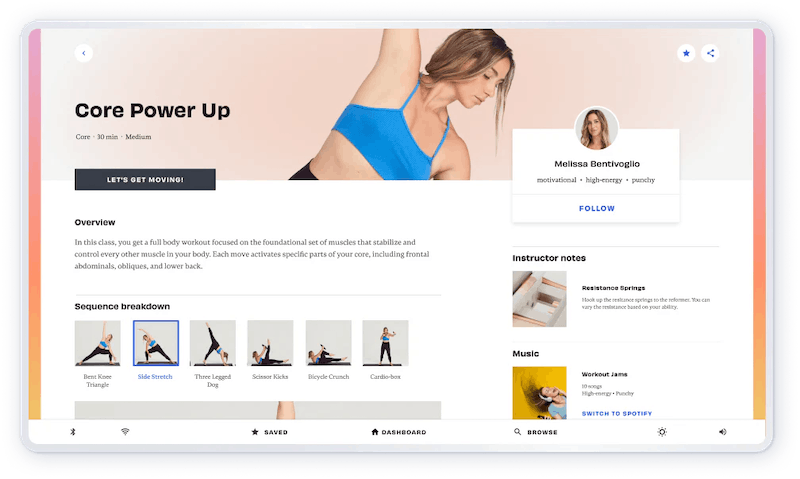

Melissa Bentivoglio, a former ballet dancer and acclaimed Pilates instructor, designed her first reformer for her studio and private clients.

A reformer is a full-body workout machine that uses springs, pulleys, and your own bodyweight. Historically, reformers have only been accessible in Pilates studios.

Video from Frame demonstrating the Reformer

When the pandemic shut down Melissa's studio, she realized how limiting traditional reformers were. Without her instruction, she found her private clients weren’t using the reformers. And for Pilates enthusiasts in general, instructor availability, rigid class times, and not enough reformers restricted when they could take advantage of the equipment.

So Melissa set out to change that, with a beautifully engineered, tech-enabled reformer you could use anywhere, anytime—and with access to on-demand classes by top-level instructors.

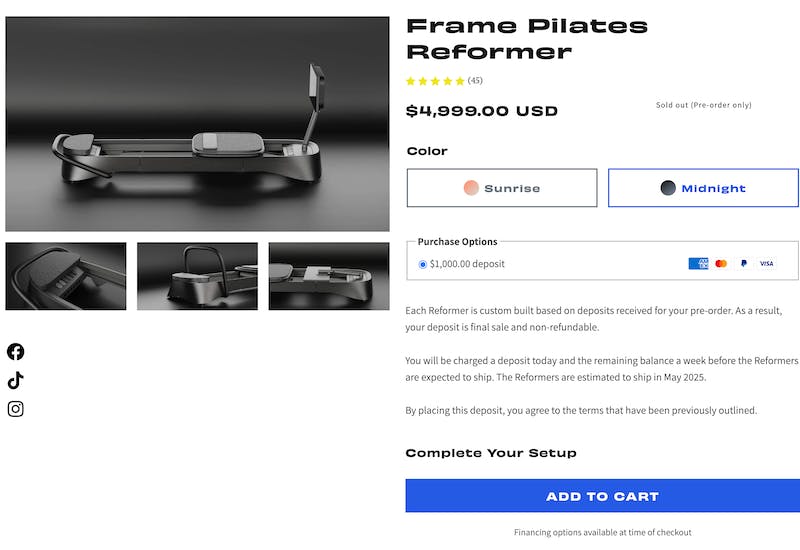

At an MSRP of $4,999 USD, the Frame Reformer sits at the high end of the connected fitness market, but represents the same value as a studio Pilates machine costing 3x as much.

With customers ranging from at-home users to businesses like luxury hotels, clinics, and high-end studios, Frame makes the highest quality Pilates experiences possible in new ways.

The challenge: Inventory shortages from unexpected demand

Many potential purchases go unrealized.

— Tom Youzwyshyn, Head of Growth, Frame

Hype for the Reformer could come in sudden waves, which meant more interested customers but also logistical issues.

"One shoutout or viral video could send your inventory forecasts out the window," Tom says.

Selling out unexpectedly meant a lag before new units were available—and an interruption in the cash flow Frame relied on to produce them.

On-demand Pilates classes accessible on the Reformer.

"While most people think of [running out of stock] as a good thing, it really impacts demand, as many potential purchases go unrealized," Tom says. "This delay causes heartbreak for our customers."

Pilates enthusiasts would try the Reformer at a hotel or stumble on it on the Internet and fall in love with the product.

But then they'd hit a dead end: no feasible way to buy one or secure their spot in line. Some looked for alternatives, and others just got frustrated.

Previous solutions

The options Frame had been able to offer customers during sold out periods were not effective:

- Charging up front: Frame tried collecting the full payment from customers up front—the only checkout payment option that Shopify online stores natively support. But few wanted to have thousands of dollars tied up waiting for a yet-to-be-planned production run.

- Collecting emails: They also tried gathering email addresses and then sending notifications when inventory was restocked. Many customers would fill in their email address to learn when an item was available. But not many would come back and buy it when it was. Or it could already be sold out again, an experience Tom personally finds maddening when it happens to him.

Frame needed a way to secure orders on their Shopify online store during these periods. It had to ensure a positive customer experience while maintaining cashflow and limiting the burden on their team.

Falling in love with the Frame Reformer at a hotel.

Choosing deposits

Frame dismissed two other options before settling on deposits:

- Invoices: Given Frame's number of orders, invoicing wasn't feasible. It would add unpredictable delays waiting for people to pay, tie up resources chasing them, and cause friction for everyone involved. ("Invoicing is a nightmare when you have many orders, full stop," Tom says.)

- Buy Now, Pay Later (BNPL) services: Frame's initial customer base weren't users of BNPL services that offer loans as a payment method at checkout. And the company didn't need to pay BNPL services' high transaction fees to offset their customers' credit risk, which would further reduce cashflow.

Looking at the larger market of high-ticket items, Frame saw a common solution was taking deposits up front and collecting the balance before shipping.

"Unfortunately, deposit offerings on Shopify are much less common," Tom says. "And, frankly, other platforms felt shady. Like you couldn’t trust who was on the other side to help support you."

Frame had to find a way to extend Shopify that they could rely on—which brought them to Downpay.

Downpay: A deposit system built for Shopify

Having a partner that stands with you frees you up from so many worries.

— Tom Youzwyshyn, Head of Growth, Frame

Downpay stood out, not just because it offered native Shopify integration and flexible deposit flows, but because it was built by former Shopify employees familiar with the platform and the needs of scaling businesses selling high-value products.

Frame could use Downpay for unexpected inventory shortages and pre-orders for the next batch of Reformers.

They could collect a deposit when customers checked out, then automatically charge the remainder to the card on file—a merchant-initiated transaction—when the units were ready to ship. (See how this works in the Downpay interactive demo.)

Ordering a Reformer from Frame's Shopify store while stock is sold out.

From setup onward, Frame found the responsive, trustworthy partner they had hoped for in Downpay's team.

“For a scaling business, having a partner that stands with you, as Downpay has, frees you up from so many worries, so you can go on and continue to execute on the vision,” Tom says.

The results: Cash flow and customer confidence

The likelihood [of collecting the balance] so far has been 100%.

— Tom Youzwyshyn, Head of Growth, Frame

Frame was able to execute on their vision: Downpay helped them turn demand surges from roadblocks into momentum.

"Downpay has been an incredible tool, bridging the divide between conversion and monetization during these periods–whether pre-order or no stock," Tom says.

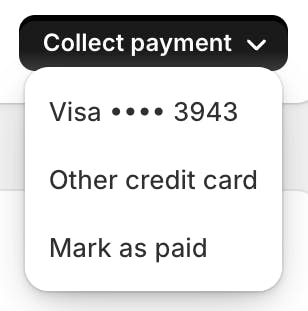

By offering non-refundable deposits with Downpay, Frame gained insight into real demand and much-needed predictability in cash flow: "The likelihood [of collecting the balance] so far has been 100% when we initiate the rest of the transaction as a merchant," Tom says.

They could automate this process, including keeping customers notified, using Downpay's API or actions for Shopify Flow. Charging the remaining amount could also be done from the order details page in the Shopify admin.

Collecting the remaining amount from the Shopify order details page with Downpay's native integration.

Frame was even able to experiment with the amount or percentage of the deposit in order to find the most efficient split—learning what their customers were comfortable spending up front to get a Reformer later.

Customers have shared how much they like the experience, Tom says. "It effectively acts as an installment option, but delivers the peace of mind that they will receive the product when it arrives.”

Knowing they could serve their customers during sellouts has created peace of mind for the team at Frame too. "It definitely has made us confident and less stressed," Tom says.

Monetizing a sudden shortage during BFCM 2024

During Black Friday 2024, Frame saw a massive spike in demand that they hadn't forecasted, resulting in them running out of stock.

"We knew that our inventory was dwindling," Tom says. They already had Downpay set up. As a result, they were able to seamlessly enable deposits before hitting zero Reformers in the warehouse.

"We were able to turn it on and capture the last 20% of our sales during Black Friday, Cyber Monday," Tom says.

Stock

Additional sales

Balances collected

Inspiring other merchants

For other Shopify merchants thinking about trying Downpay, would Tom recommend it?

“Absolutely,” he says. “It allows for monetization during a period that’s typically zero revenue for sold-out products."

"But that’s just for us," he continues. "Downpay could be many things to other brands. It could be a pre-launch or crowdfunding tool, all on your own page. And it could also be a BNPL alternative for companies that sell custom products."

Further reading

Check out other case studies to learn how Downpay enables more sales for Shopify merchants.