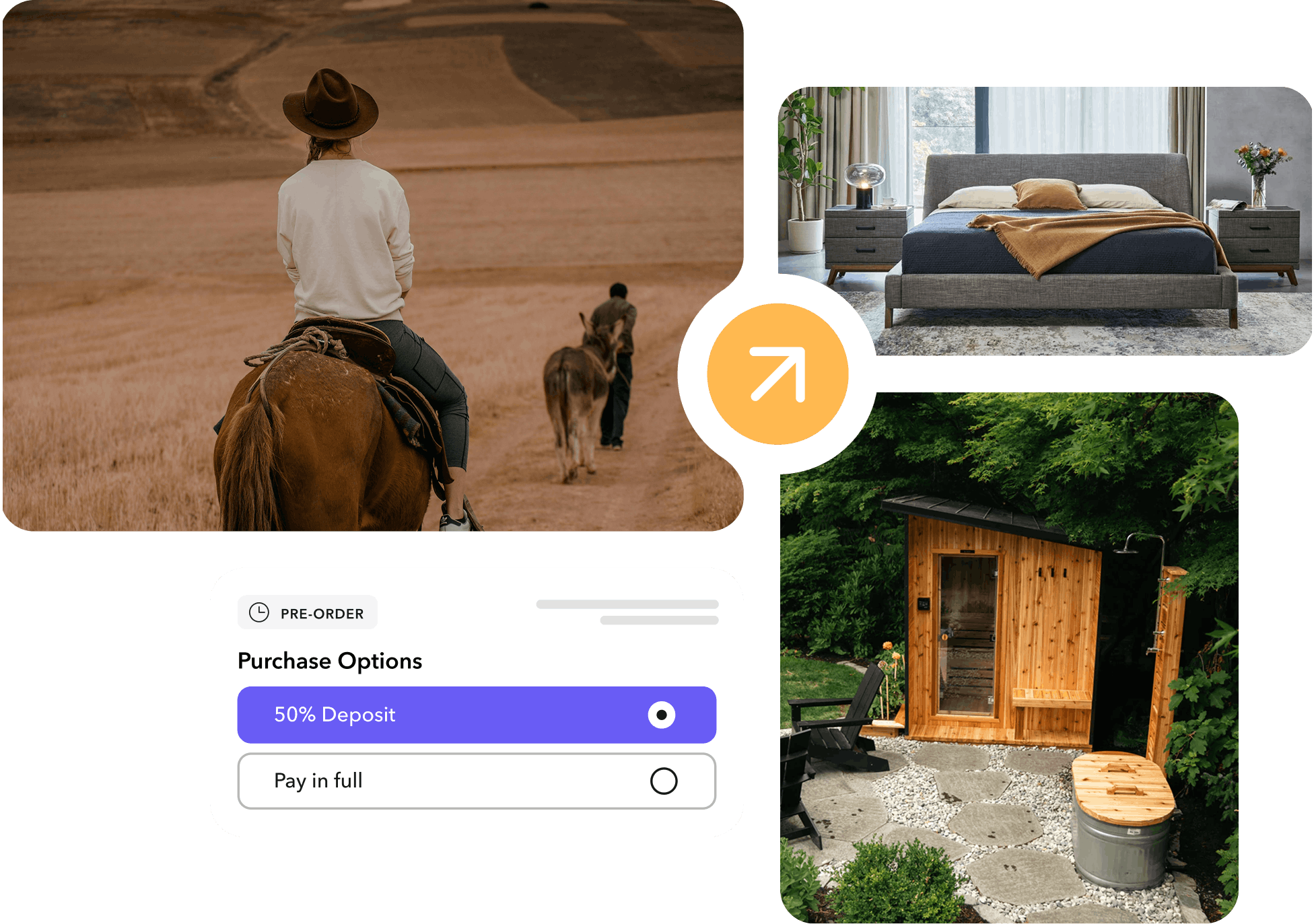

Pre-orders

Use deposits on Shopify pre-orders to lock in revenue and forecast demand accurately, while offering customers flexible payment terms.

Merchants bringing premium products to market often face the same obstacles:

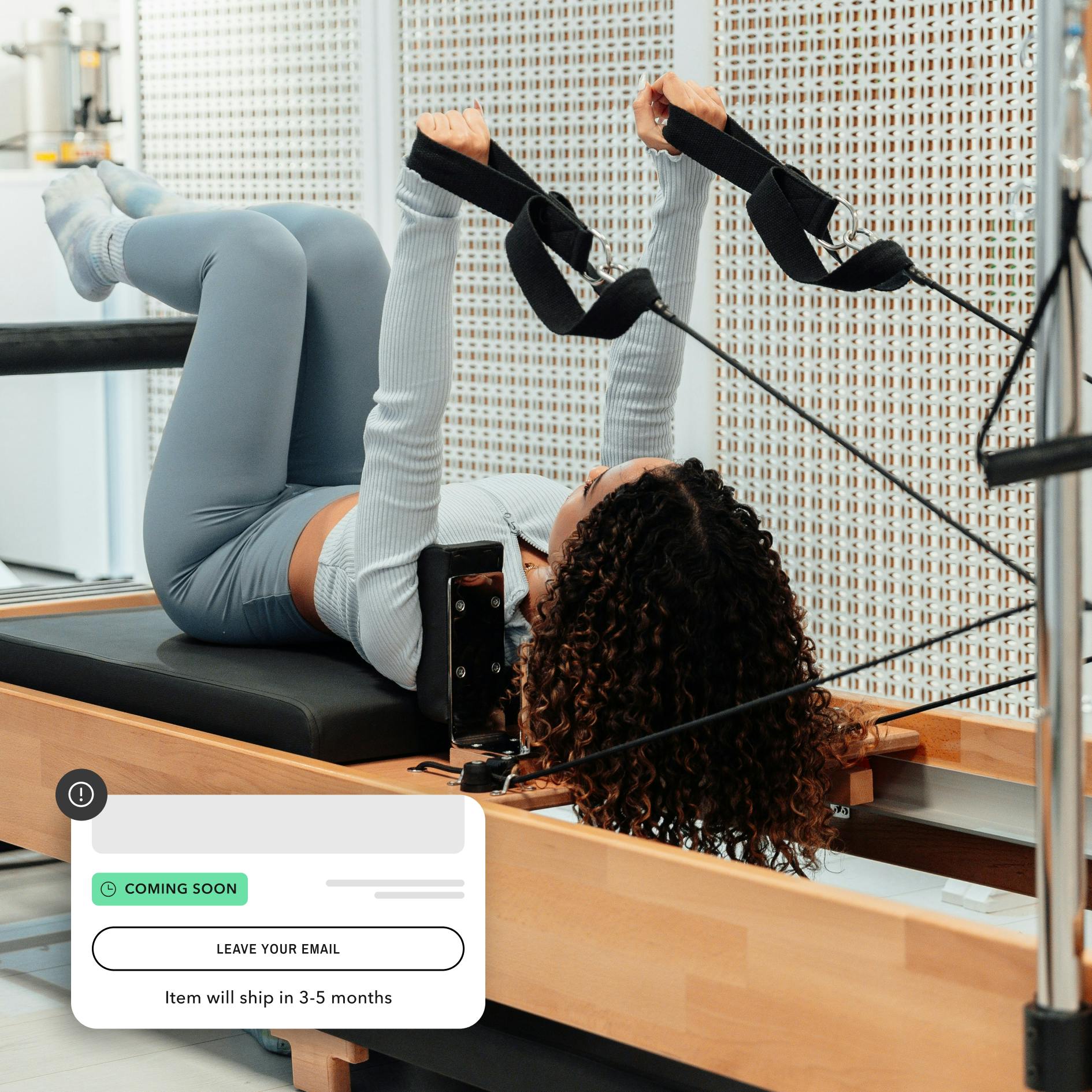

Checkout hesitation

High upfront costs cause customers to abandon when the product is not yet available.

Low-commitment signups

“Coming soon” pages or waitlists capture interest but don't always convert into paid orders.

Cash flow gaps

Without deposits, revenue is delayed and production planning remains uncertain.

Downpay makes pre-orders for high-value products seamless in Shopify Checkout, giving merchants reliable revenue and customers clear payment terms.

Deposit-based pre-orders

Orders are secured with an upfront deposit, creating commitment without full payment upfront.

Automated balance collection

Remaining payments are captured automatically on the scheduled date, ensuring cash flow without manual follow-up.

Downpay in action

With Downpay, Frame could capture pre-orders for its connected fitness equipment, forecast cash flow, and grow customer loyalty.

“Downpay solved a critical pain point for us: we had to contact each customer to get invoices paid. Now we can vault cards, communicate when the balance will be charged, and capture it when the order is ready in 3 months.”

Benefits

Why brands with pre-orders trust Downpay

For merchants

Pre-order commitment

Deposits provide demand signals backed by real revenue.

Cash flow for production

Deposits fund manufacturing without loans or financing.

Less admin work

Automate scheduling, reminders, and balance collection.

For customers

Flexible payment

Secure premium items without paying in full upfront.

Clear timelines

Transparent information on when balances will be charged.

Peace of mind

Confidently reserve high-value products without financial risk.

FAQ

Have a question?

Deposits turn intent into commitment, providing real revenue and more accurate signals of demand for production and inventory planning.

Yes. Downpay is fully integrated into Shopify Checkout, so customers never leave the store or log in elsewhere to complete payment.

Downpay supports credit cards on select payment gateways, and Paypal Express.

Merchants can send reminders through Shopify Flow and Shopify Email or apps like Klaviyo to keep customers informed about balance collection due dates.

You can automatically collect the remaining balance on a specific date or even send invoices to allow customers even more flexibility.

Ready to launch