Preventing and winning Shopify chargebacks

Learn how to prevent and fight Shopify chargebacks, especially on high-value orders, with expert tips from a certified dispute specialist.

Learn how to reduce disputes and safeguard high-value orders from a certified chargeback analyst

If you’re a Shopify store owner, chances are you’ve already faced a chargeback or will face one in the future.

You ship a product, provide tracking, and offer great service. Then out of nowhere, the bank notifies you that the customer has filed a dispute, and that they're initiating a chargeback for that transaction.

Money is immediately withdrawn from your account. You lose the sale, the product, and your time. You can fight it, but even if you marshal the evidence to argue the case and win, you may still be out a chargeback fee from the bank.

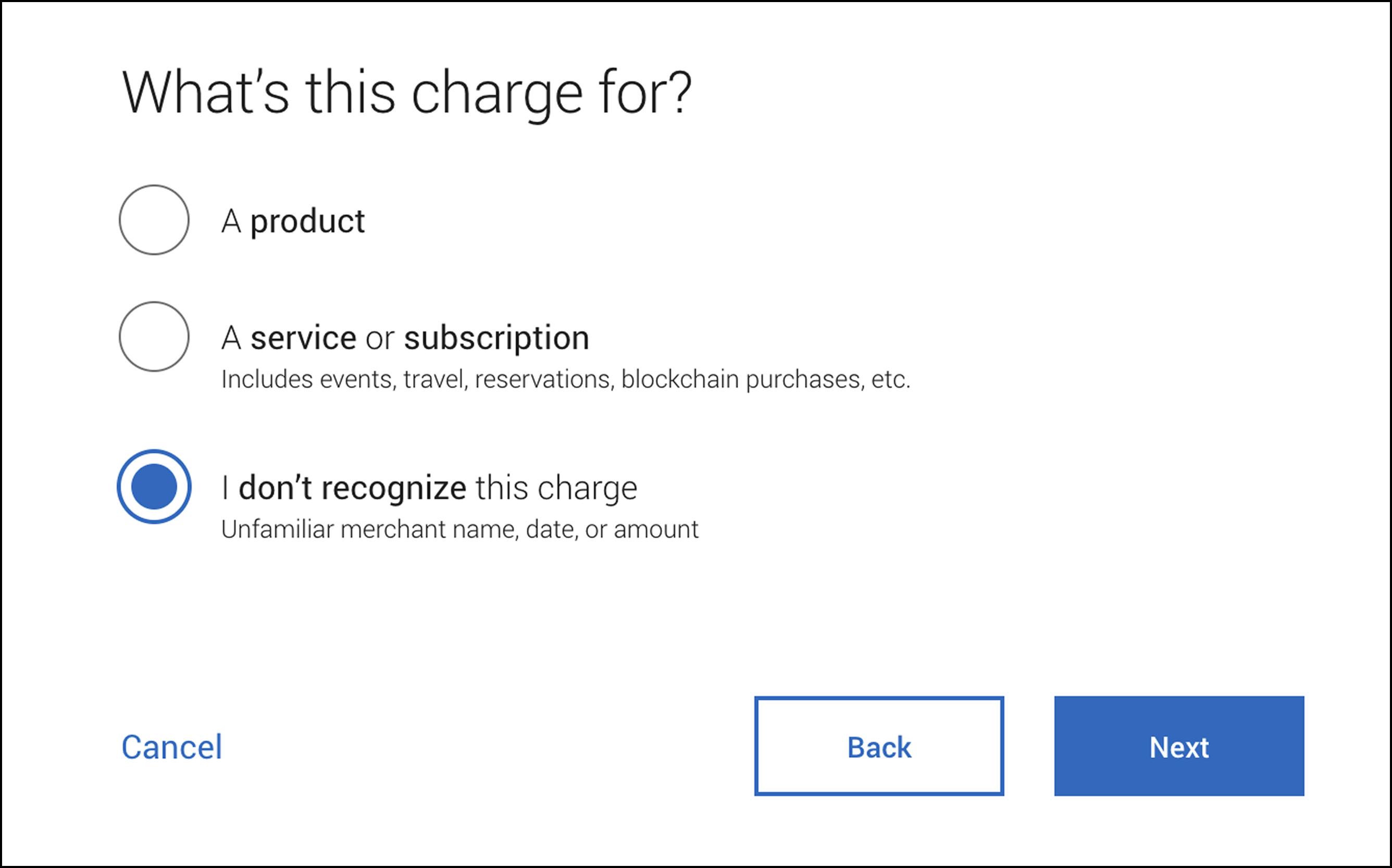

Royal Bank credit card dispute interface

Chargebacks are one of the most frustrating factors for Shopify store owners. You can do everything right and still find yourself losing both revenue and inventory.

And the cost of chargebacks to merchants keeps increasing. According to Mastercard:

The financial impact of global chargebacks is expected to grow from $33.79 billion in 2025 to $41.69 billion in 2028. This represents a 23% increase over just three years.

So, what exactly are Shopify chargebacks? Why do they happen? And more importantly, how can you protect your store from these silent profit killers?

This article walks through:

- What chargebacks are

- When they typically happen

- How to prevent them

- Disputing chargebacks

- Understanding big-ticket disputes

- Limiting exposure to chargebacks on large orders

- Why high-value cases require expert help

About Downpay

Downpay is an app for collecting deposits on Shopify and charging the balance to the card on file, built by Shopify alumni. How Downpay helps high-value merchants limit the impact of chargebacks appears in the section on reducing big-ticket charge disputes.

What is a Shopify chargeback?

A chargeback is a reversal of a credit card payment initiated by the customer through their issuing bank.

On Shopify, chargebacks are managed through the platform’s integration with payment gateways like Stripe, PayPal, and Shopify Payments.

When a customer files a chargeback, the disputed amount is deducted from your merchant bank account, along with a chargeback fee, and you’ll need to provide evidence to fight it if you believe it was unjustified.

Even if you win, the bank still requires you to pay the chargeback fee. Shopify might cover it, but it depends on your location.

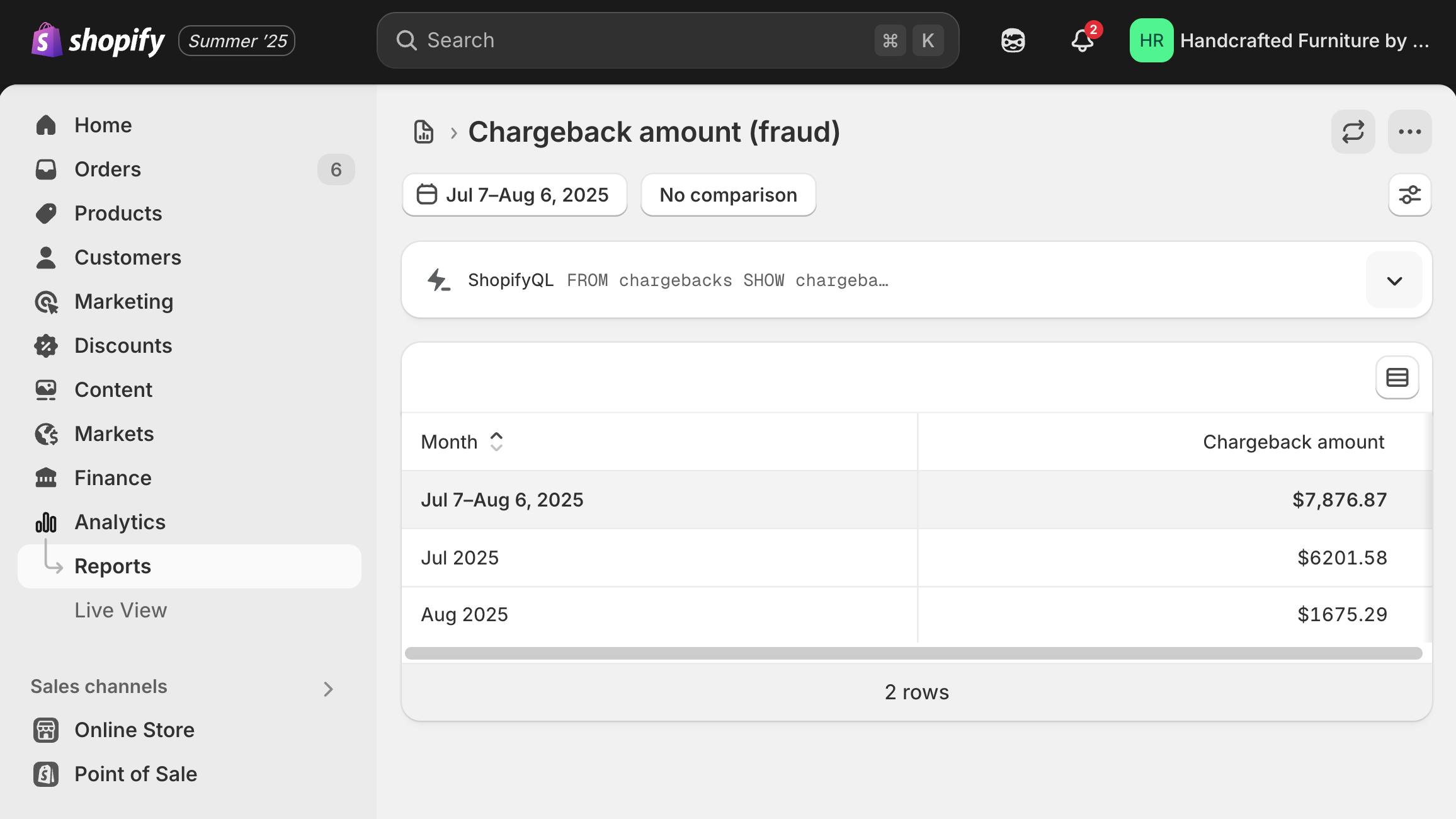

Shopify chargeback reporting.

Common reasons for chargebacks

Chargebacks can happen for a variety of reasons. Here are the most common:

- Fraudulent or unauthorized transaction: Customer claims they didn’t make the purchase.

- Item not received: Customer says the item never arrived.

- Not as described or defective: Customer claims quality issues or misleading product details.

- Subscription cancelled: Customer cancelled subscription or didn’t expect automatic renewal.

- Credit not processed: Customer says credit was agreed upon but not applied.

- Duplicate charge: Customer was charged twice for the same order.

Even with solid evidence, merchants may still lose cases, especially because of what's known as "friendly fraud." This is when the customer receives the product but disputes the charge as unauthorized, whether they mean to commit fraud or not.

When do chargebacks happen?

A chargeback will usually happen within 120 days of the service rendered date, although this may vary by issuer. In Shopify, the system alerts you when a chargeback is filed and provides a due date to submit your response, usually within 7-30 days.

Disputes often surface:

- After a delivery has been confirmed

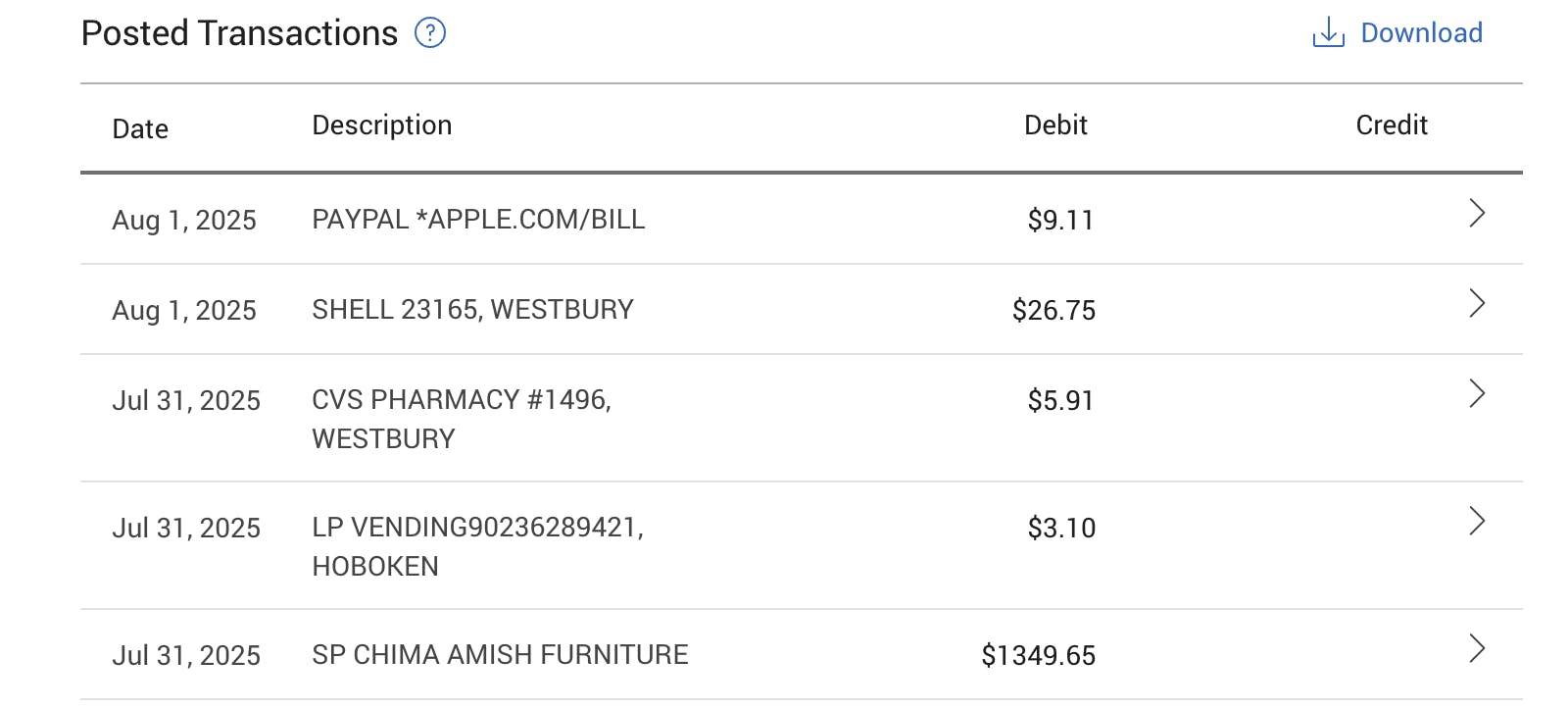

- When a customer receives a credit card statement and doesn’t recognize the charge

- When the customer experiences service or product issues and wants to bypass your refund policy

How to prevent Shopify chargebacks

While no store is totally immune, here are 5 proven steps that reduce your risk, whether your AOV is $100 or $10,000:

1. Optimize descriptors

- Make sure your store name matches the charge shown on bank statements (checkout and billing descriptors).

Royal Bank Visa bill with descriptors.

2. Communicate clearly

- Send order confirmations and tracking updates. Get confirmation where possible.

- Make refund and cancellation policies visible and easy to understand.

- Offer multiple channels (like email, live chat, Messenger, or WhatsApp) for customers to reach out.

- Ensure any confirmations you provide in writing are accurate. False confirmations can be used as evidence during chargebacks.

3. Deliver on time with proof

- Use trackable shipping and require signatures for high-value orders.

- Save delivery confirmation screenshots and timestamps.

- Choose companies who provide photographic evidence of delivery.

Photo by RDNE stock project.

4. Identify red flags

- Use fraud prevention tools like AVS, CVV and review transactions.

- Watch for inconsistent shipping addresses, bulk orders, or suspicious patterns.

- Avoid fulfilling questionable orders if they trip fraud filters.

Fighting chargebacks the right way

Many merchants rely on generic templates to respond to disputes. But what is most likely to win is a customized response that speaks directly to the reason code, with relevant evidence and a compelling story.

For example:

- If a customer claims fraud, your response must explain how only the cardholder could have placed the order (such as matching billing/shipping addresses, CVV2 validation, IP address logs, or proof of a past transaction).

- If they say they didn’t receive the item, attach proof of delivery and link it to your fulfillment timeline and terms.

Winning a chargeback is not a box-checking exercise. You have to make the bank believe your side of the story, something that only gets harder with the value of the chargeback.

Handling high-value chargebacks

As Shopify stores grow, so do the stakes. Losing 5 extra chargebacks per month at $1000 each? That’s $60,000 gone per year. And that doesn't count the impact of inventory losses and processors flagging you as risky.

Stores selling high-value goods need to put in more work, both in advance to protect themselves, and after a chargeback is issued, in order to limit the impact.

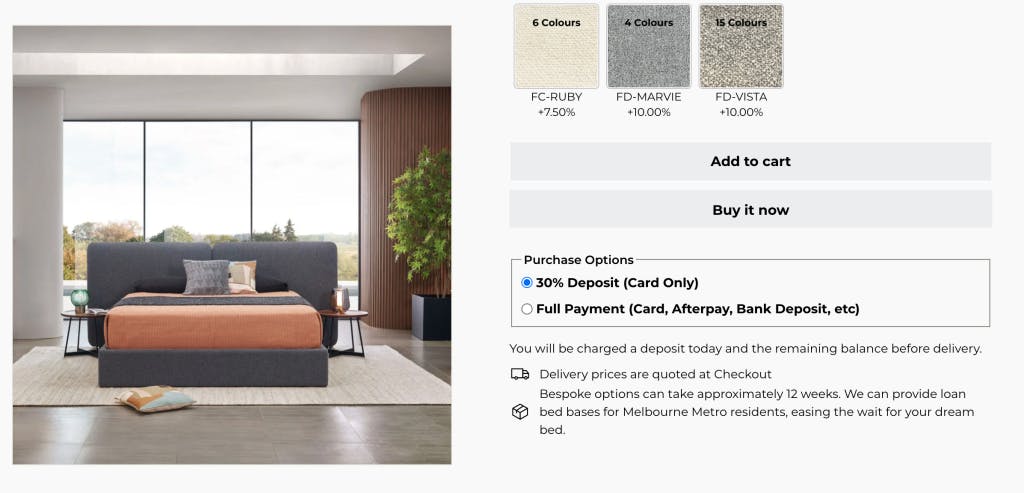

1. Reduce your exposure with a deposit payment option

If you sell high-value goods with a lead time—such as made-to-order items, backorders or preorders—collecting a deposit up front and then charging the balance when you're ready to ship can reduce the impact of chargebacks. For the ones you aren't able to win, having to write off $300 on a $1,000 piece of furniture is a lot better than absorbing the full cost.

Downpay offers a solution for accepting deposits natively in the Shopify checkout and then manually or automatically collecting the remainder from a card on file.

Gainsville uses Downpay to collect a 30% deposit on luxury made-to-order furniture

2. Get help resolving big-ticket disputes

In high-value chargeback cases, more detailed, customized dispute responses are mandatory. Banks also scrutinize them more carefully.

Winning these cases depends not just on proof of delivery, but also on:

- How well your evidence is packaged

- The logic of your rebuttal letter

- Whether it addresses the bank’s reason code effectively

So what do you do to address these requirements and increase your win rates? Bring in an expert.

How to take advantage of expertise

At card issuers, high-value cardholder disputes are handled by chargeback analysts.

Your best value comes from hiring a chargeback expert who has hands-on expertise and knowledge working in dispute management for a card issuer as well as for merchants.

If an expert can help you win 2 of those thousand-dollar chargebacks per month, that's $24,000 recovered. And like lawyers, you can find experts who will only charge you a percentage if you win.

Experts understand:

- Which documents matter

- Which aspects of the chargeback process can be outsourced and where, which can save versus full-time staff hours

- How to structure responses for better win rates

- What language banks respond to

- How to implement effective strategies in future

Final thoughts

Chargebacks are a business risk, not just a payment issue. Whether it’s optimizing your process to prevent high-value disputes or preparing airtight evidence to fight them, the key is to stay proactive.

You wouldn't have a non-lawyer create your legal strategy and represent you in court. When the stakes are this high, take advantage of professional help.

Frequently asked questions about Shopify chargebacks

What is a Shopify chargeback?

It’s when a customer of a Shopify merchant disputes a charge through their bank instead of requesting a refund, resulting in a reversal of the payment (plus fees).

Why do chargebacks happen if I delivered the item?

Customers may dispute charges due to confusion, dissatisfaction, or "friendly fraud," which is when they receive the item but still file a claim.

How do I win a Shopify chargeback dispute?

Success depends on strong, customized evidence tied to the dispute reason. Generic templates often don’t work.

How do I reduce chargebacks on Shopify?

Use clear billing, trackable shipping, fraud filters, and strong communication. For high-value orders with lead times, requiring deposits can help.

When should I hire a chargeback expert?

If you’re facing high-value disputes, an expert can improve your win rate and reduce future risk.

About the author

Bibek Ghimire, the founder of Chargeback Specialist, is a professional banker and chargeback expert, certified by both Visa and Mastercard, with more than a decade of experience and deep understanding in issuing-side and acquiring-side disputes.

LinkedIn | Website